Donor Story: Gift Annuity for Real Estate

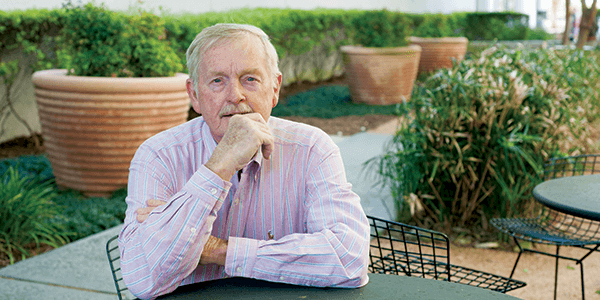

Jonathan: My home has been a wonderful investment. My late wife and I raised our kids there, but it was getting more difficult for me to keep up with the yard work. I wanted to sell my home and move to a condo. With fewer responsibilities, I would be able to spend more time with my grandkids.

Jonathan talked to his favorite charity's gift planner, who told him he could sell the home, avoid the tax and make a generous gift to AFMDA.

Jonathan: I learned a lot from my conversation with the gift planner. She told me that I could sell my home to AFMDA for $130,000, which would give me the money I needed to buy the condo. AFMDA would take the balance of the value of my home, $290,000, to fund a charitable gift annuity that would give me both a tax deduction and provide me with fixed payments for the rest of my life.

Jonathan transferred his home to AFMDA in exchange for the charitable gift annuity. The gift annuity produced a nice tax deduction that Jonathan used to offset the gain on the sale portion to AFMDA. He also used the home exclusion to offset the remaining capital gains associated with the payments he received from the annuity.

Jonathan: Using my home to fund the gift annuity was the best decision I could have made. I avoided tax on the sale of my home and really enjoy the benefits of the large annuity payments. Best of all, because the payments are fixed, I don't have to worry about market fluctuations.

Is a charitable gift annuity for real estate right for you?

If you own highly appreciated property, such as real estate, you could benefit from using the real estate to fund a charitable gift annuity. The annuity, coupled with the use of a home exclusion, could help you avoid capital gains, provide you with a charitable income tax deduction in the year of the gift and could increase your income.

Please us if you have questions about charitable gift annuities. We would be happy to answer any questions that you have.

*Please note: The name above is representative of a typical donor and may or may not be an actual donor to our organization. Since your gift annuity benefits may be different, you may want to click here to view an example of your benefits.